Have financial reporting materials to update too? That's several more hours that Modeloptic will save you every month.

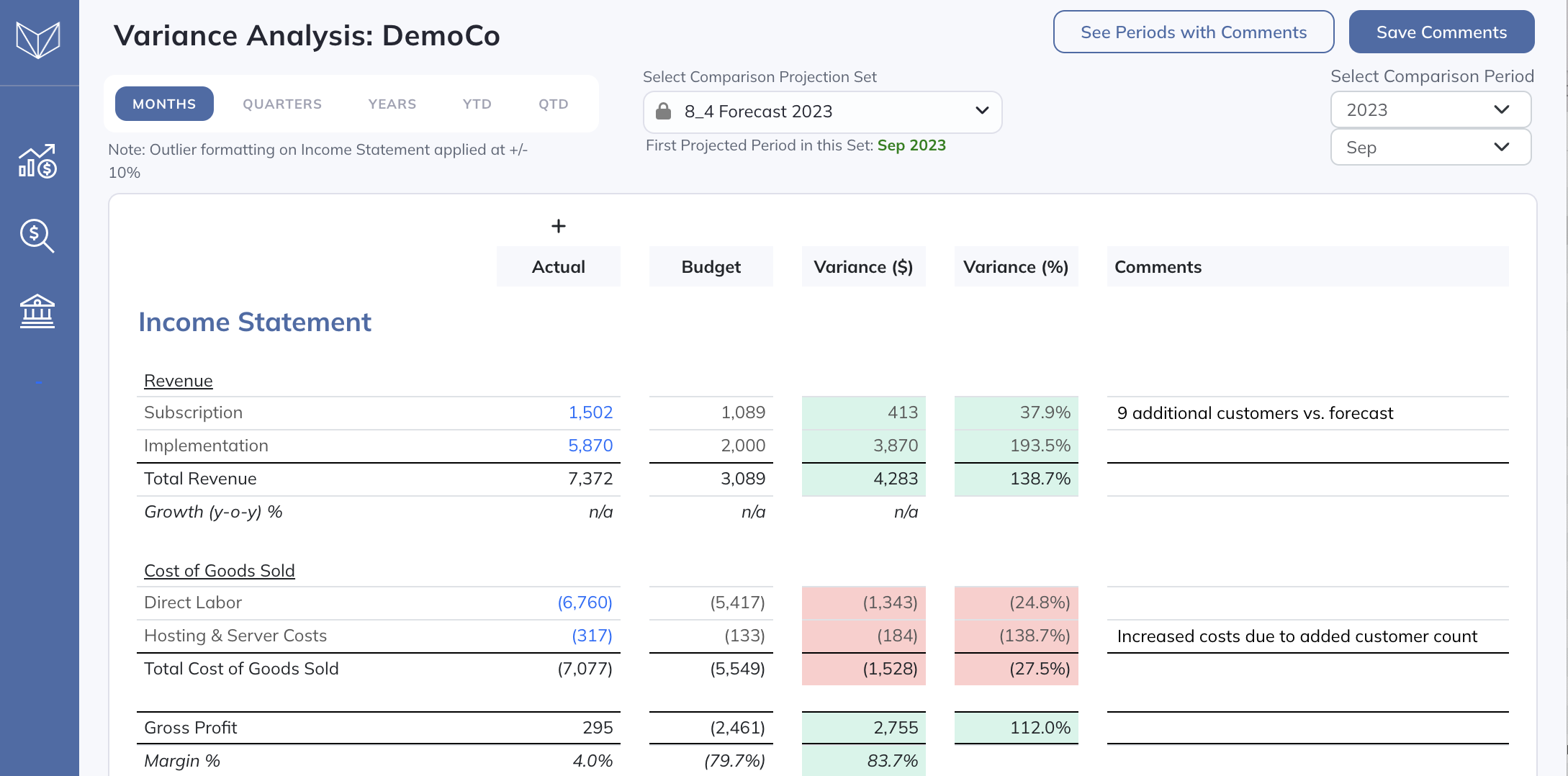

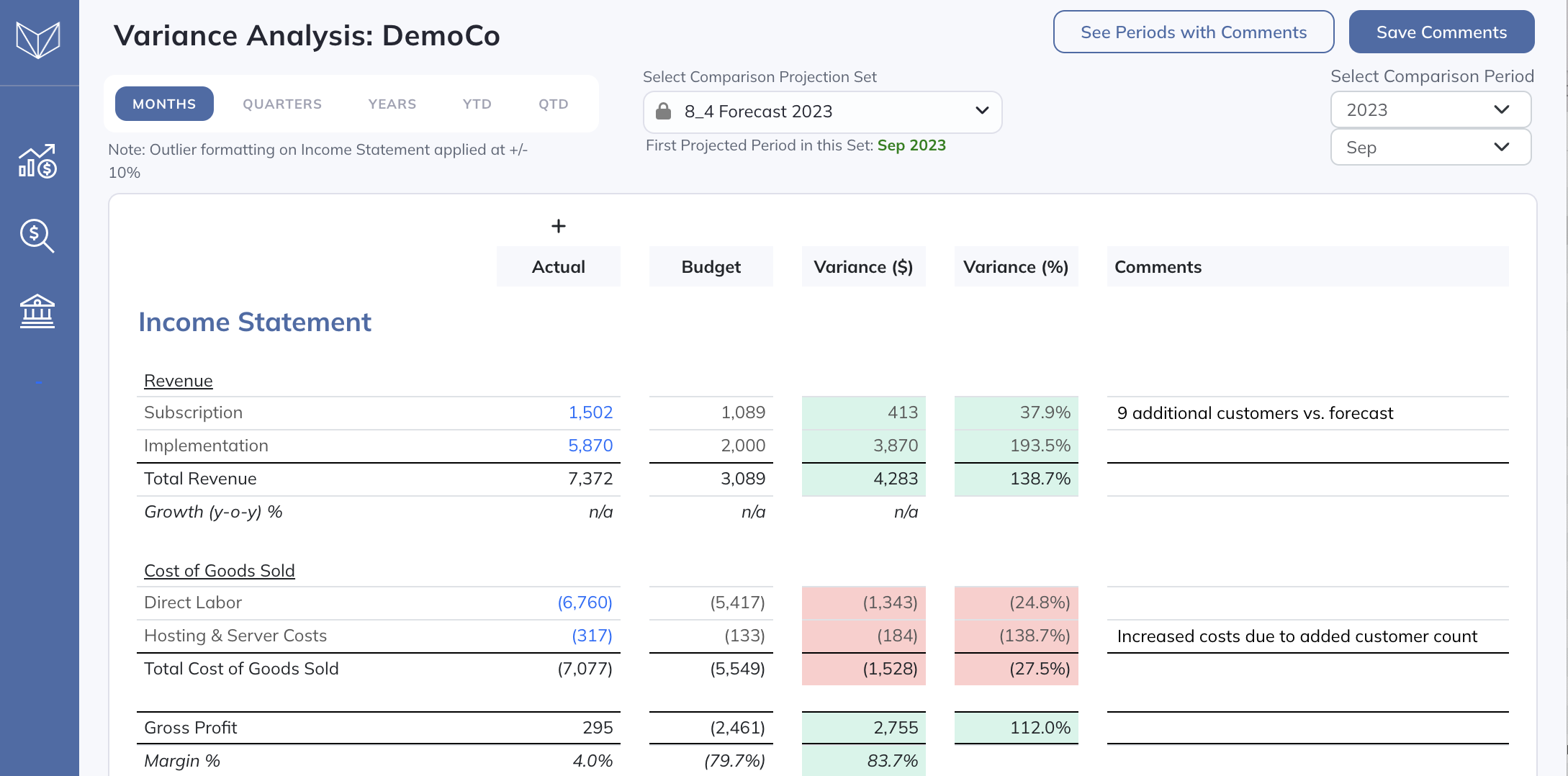

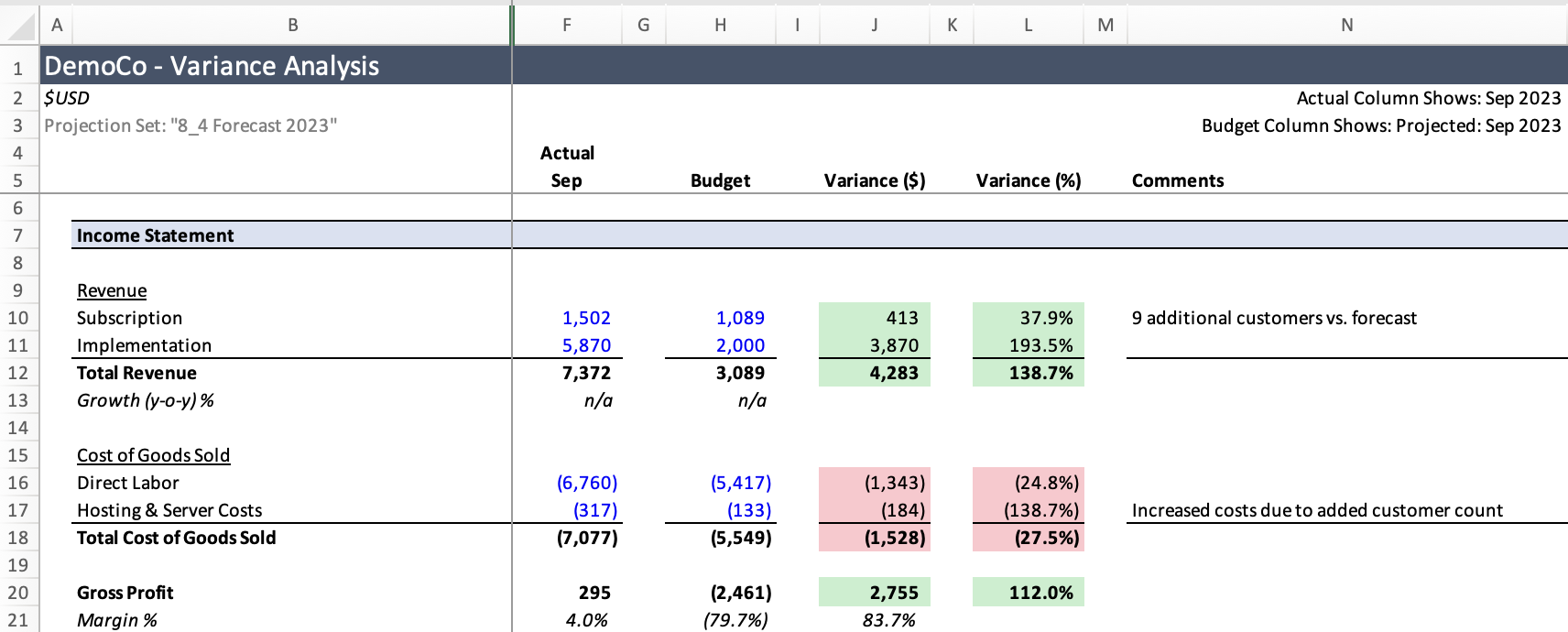

Especially if you need to run variance analysis, which Modeloptic can do automatically.

Have financial reporting materials to update too? That's several more hours that Modeloptic will save you every month.

Especially if you need to run variance analysis, which Modeloptic can do automatically.

Most FP&A teams have a lot of tasks that can easily be automated. Forecasting and reporting are two big ones. Most people still do this by hand in Excel.

If you're reading this, you're probably already sold on the value that FP&A brings to your Company. If your Company is at any level of scale, FP&A is critical to keeping things on the rails, not to mention the strategic insights that it can bring to the surface. If we're being honest though, there's a lot of drudgery involved before those insights start to be uncovered. Modeloptic can help with that.

The truth is: Your time is expensive, and valuable. You should be spending it on strategy, not mechanical Excel updates.

People in most other parts of the business have a specialized, purpose-built software tool that they live in every day that makes their lives easier. Sales has their CRM, engineering has their development tools, accounting has an accounting system, HR has their own tools, but FP&A has... Excel.

Excel is great, and it's extremely flexible, but it also requires a ton of manual labor and attention to detail to be productive.

Isn't it time that FP&A gets a dedicated tool as well?

Most FP&A teams have a lot of tasks that can easily be automated. Forecasting and reporting are two big ones. Most people still do this by hand in Excel.

If you're reading this, you're probably already sold on the value that FP&A brings to your Company. If your Company is at any level of scale, FP&A is critical to keeping things on the rails, not to mention the strategic insights that it can bring to the surface. If we're being honest though, there's a lot of drudgery involved before those insights start to be uncovered. Modeloptic can help with that.

The truth is: Your time is expensive, and valuable. You should be spending it on strategy, not mechanical Excel updates.

People in most other parts of the business have a specialized, purpose-built software tool that they live in every day that makes their lives easier. Sales has their CRM, engineering has their development tools, accounting has an accounting system, HR has their own tools, but FP&A has... Excel.

Excel is great, and it's extremely flexible, but it also requires a ton of manual labor and attention to detail to be productive.

Isn't it time that FP&A gets a dedicated tool as well?

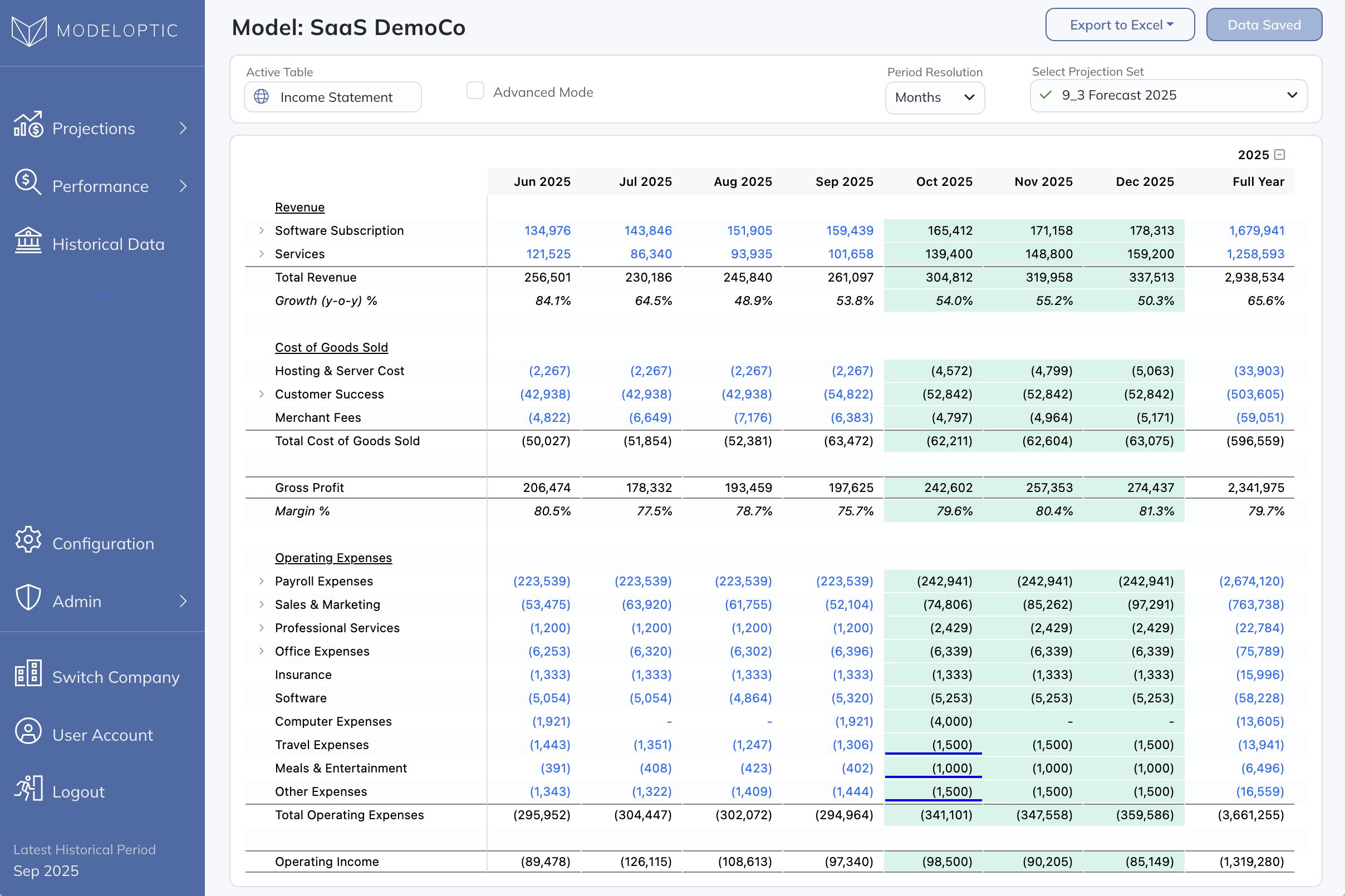

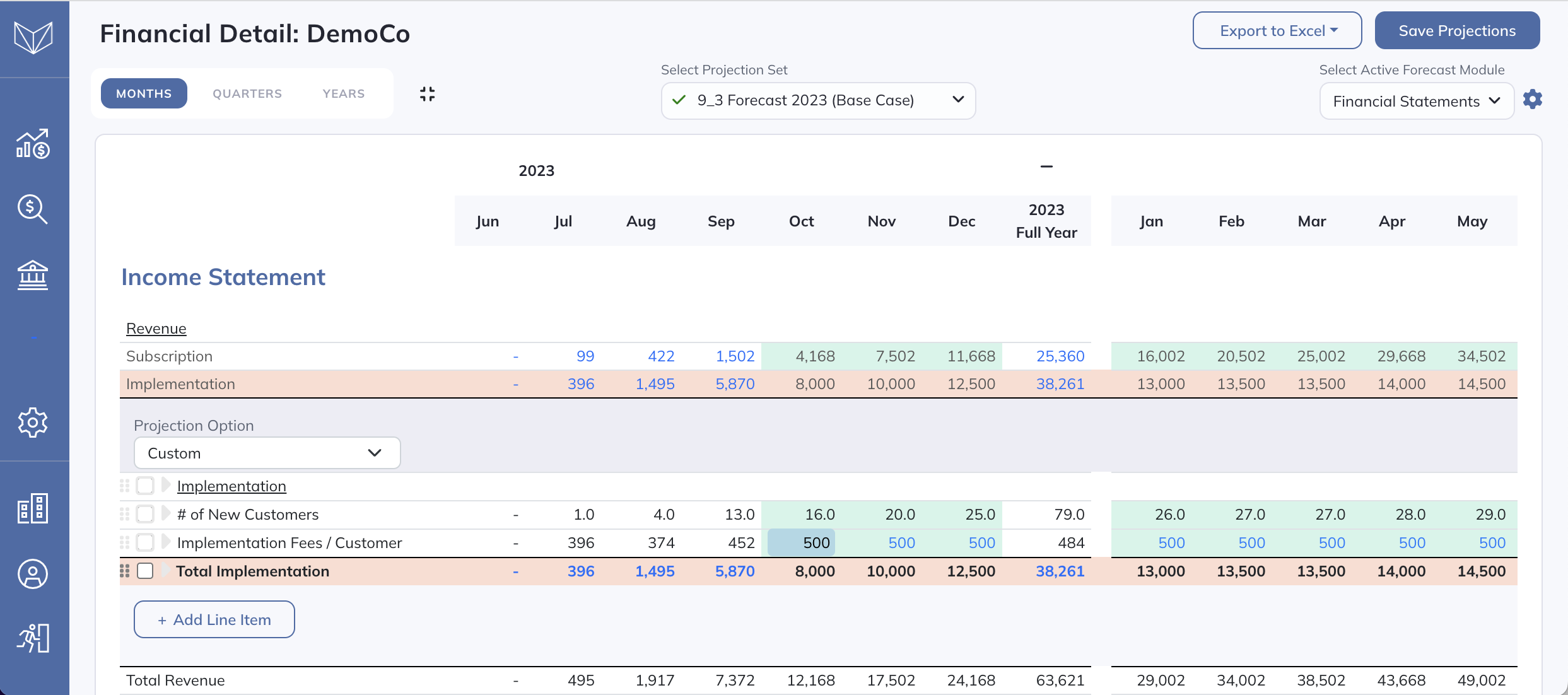

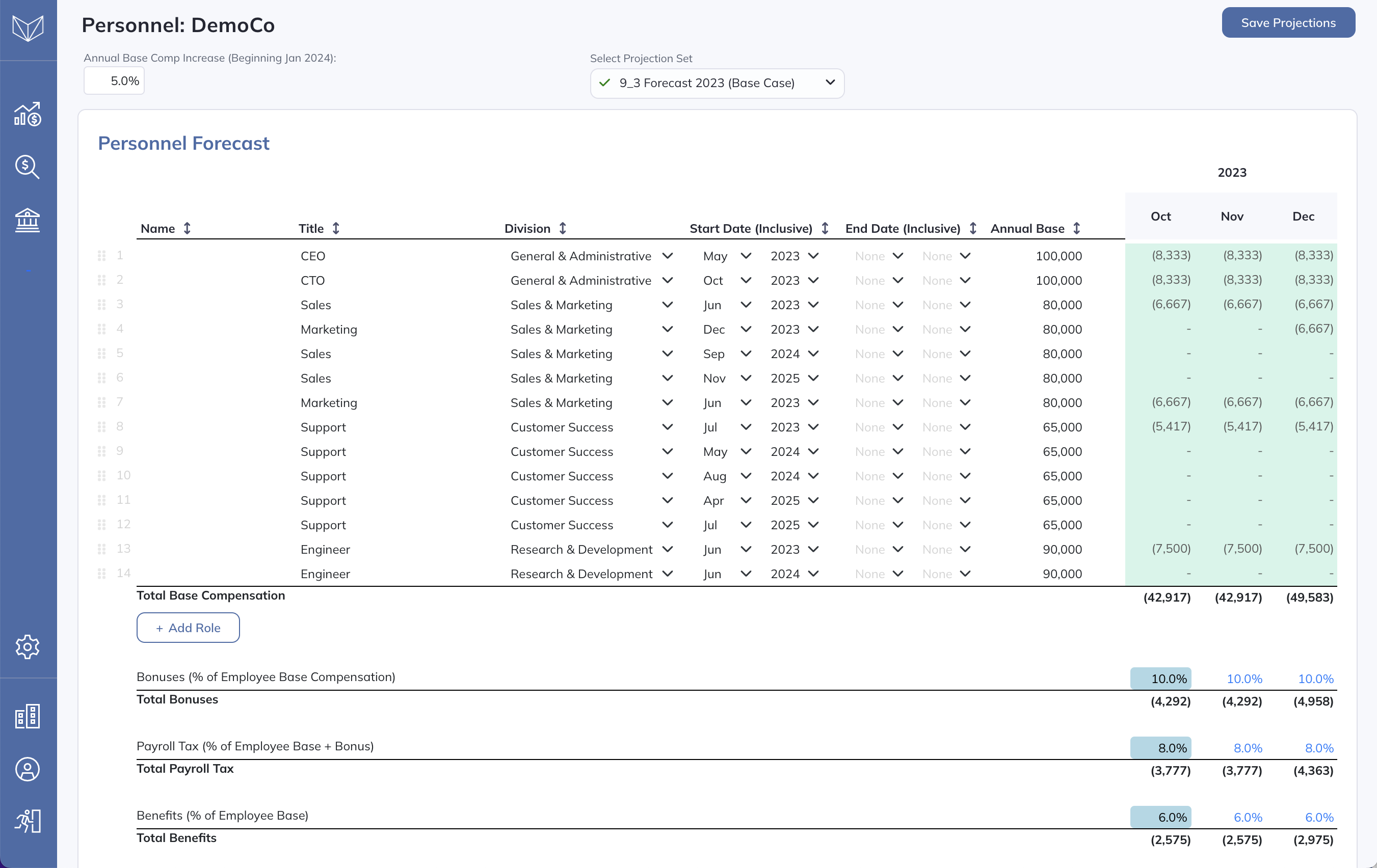

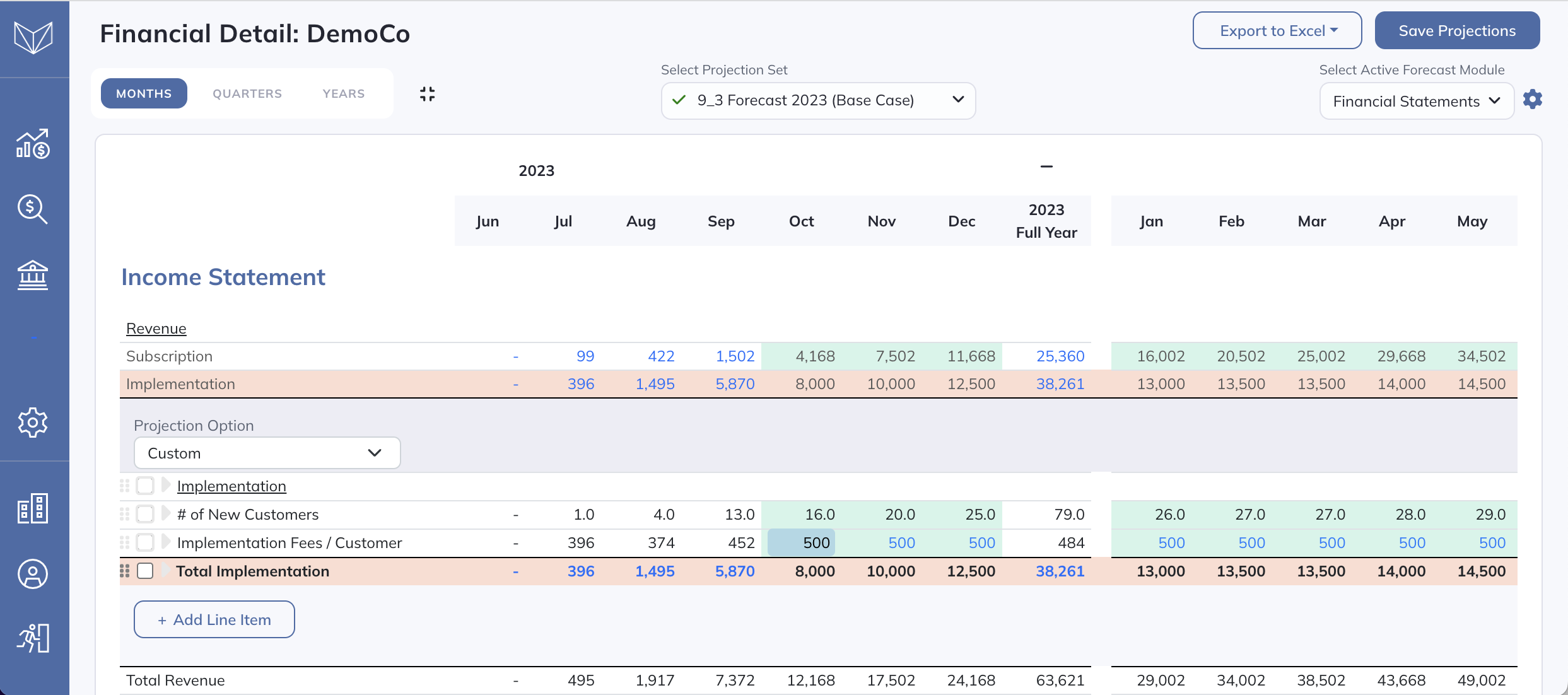

It offers great off-the-shelf capabilities for quickly and easily building and adjusting your forecasts, while still maintaining the power and flexibility of Excel. It automates away most of the mechanical slog required in building a forecast in Excel.

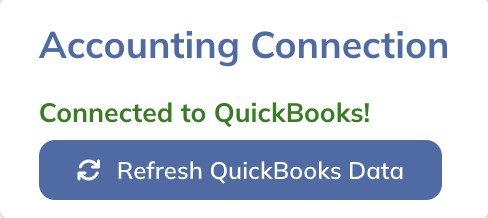

Modeloptic directly integrates with your accounting system, so updating your model with the latest actuals is almost entirely automated.

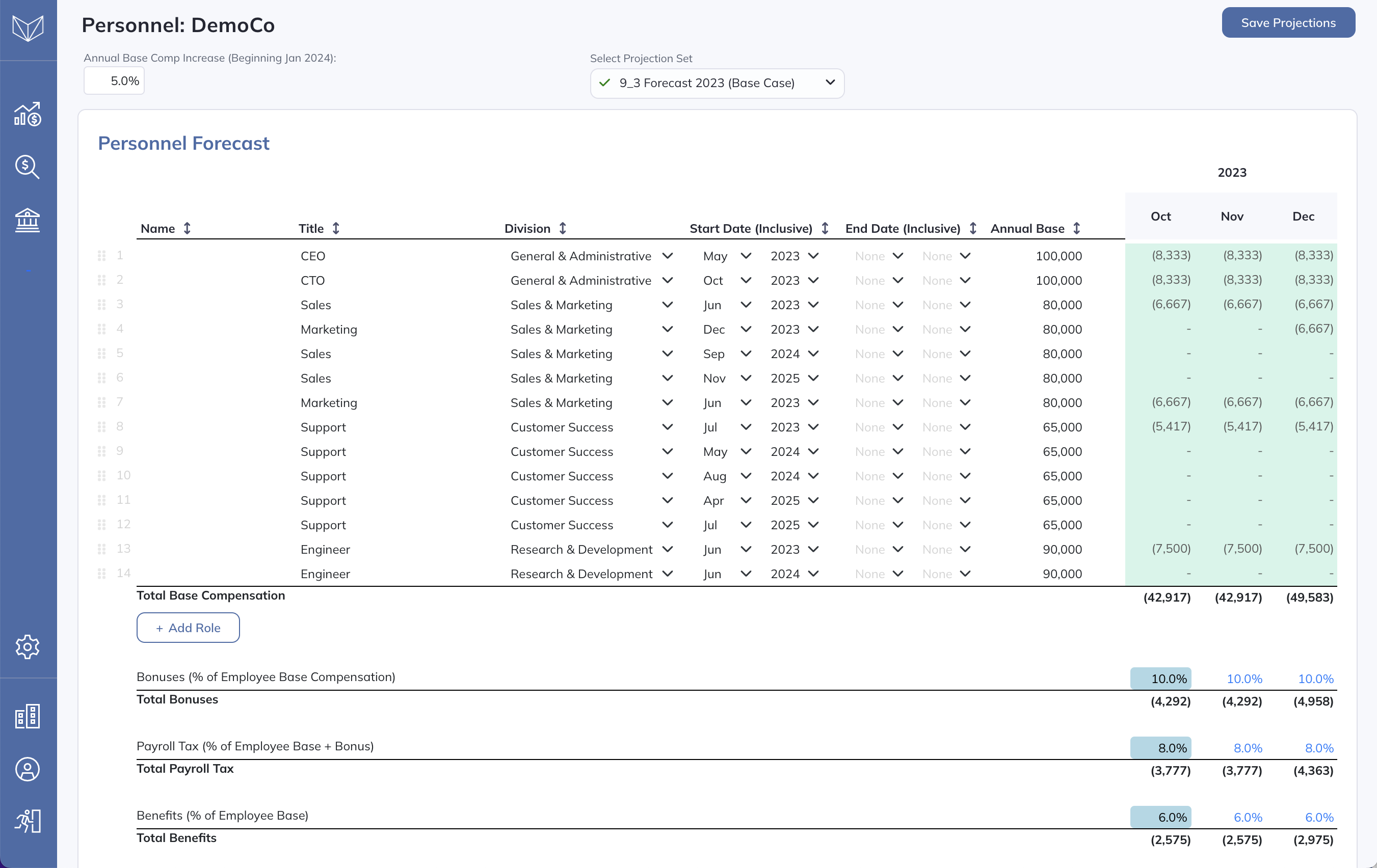

You'll then load in any key operating metrics that are relevant to your business, both for the sake of integrating them into your reporting as well as for use as drivers in your forecast. By doing this, you'll have the full picture of your company, including non-finance KPIs, all in one place.

Instead of combing through every tab of your model every month and making sure every formula in every relevant cell is pointing to the correct place, Modeloptic can do all that for you. That eliminates many major potential sources of error, not to mention all that manual labor. Free yourself up to focus on higher value tasks!

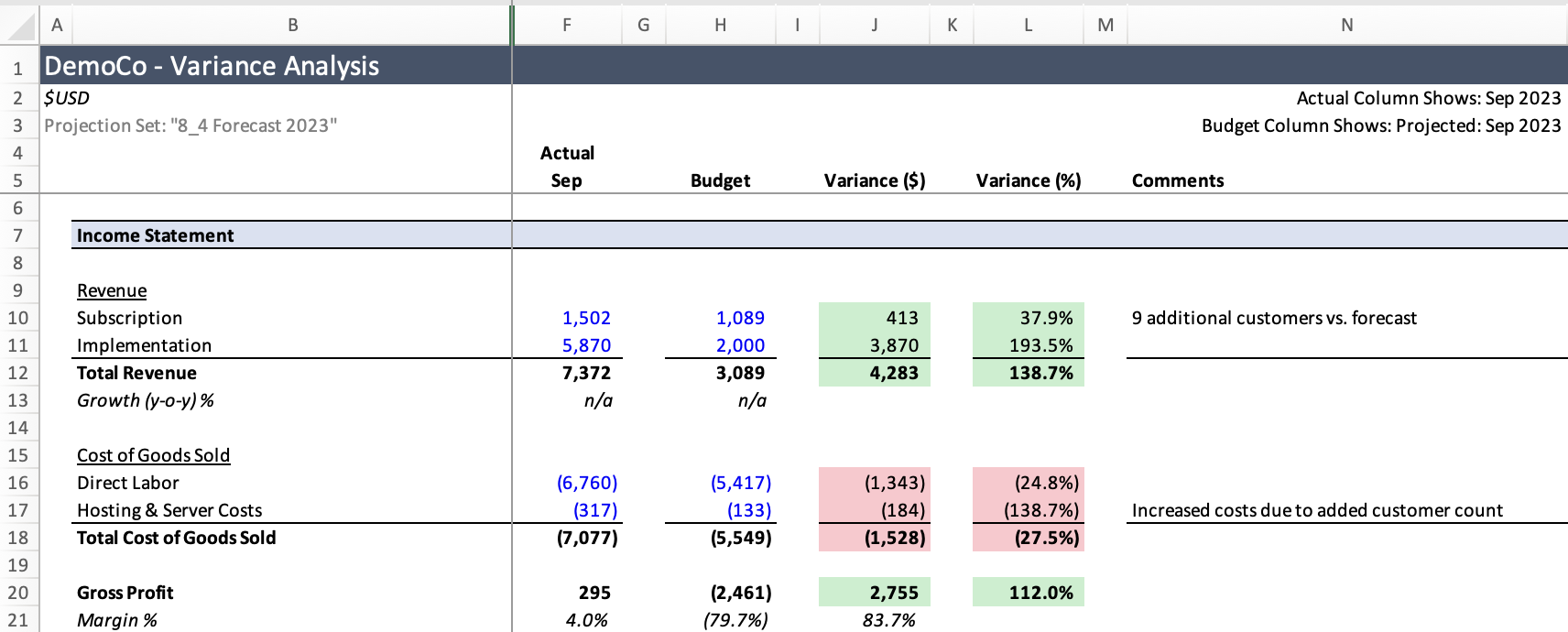

When you do your monthly reviews as part of closing the books, much of that can be done right inside of Modeloptic. Having your variance reports generated for you automatically saves a ton of time, and removes major potential sources of error. Having those quickly available allows you to easily compare actuals versus plan and ensure that everything has been booked properly.

Doing your reviews within Modeloptic also gives you the major advantage of being able to see transaction level detail pulled from your accounting system from within your variance reports (as well as your forecast). Simply click on a historical value and you'll see the transaction components for the given period and account. You can't do that inside of Excel!

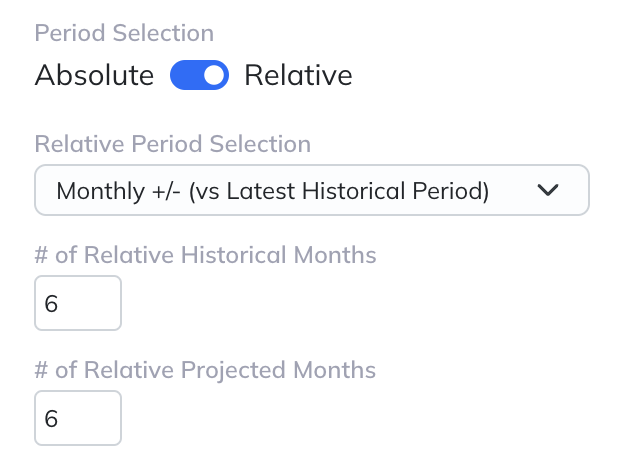

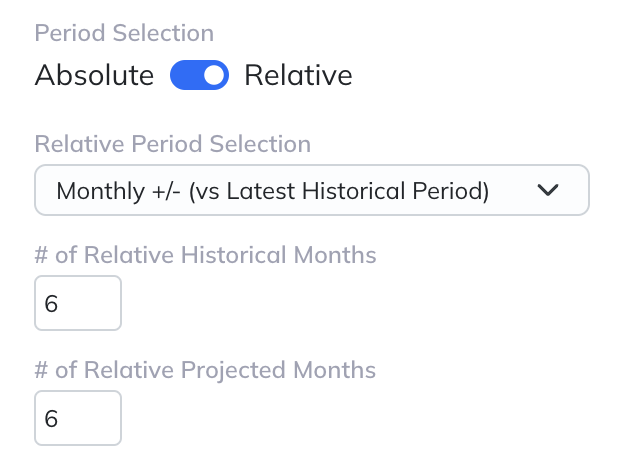

Modeloptic supports relative time references for items like graphs and data tables on your reports, so they'll automatically roll forward to show the correct periods along with your forecast.

You can then generate a PDF of your reports, or export whatever pieces you need to incorporate into other reporting materials you might be preparing.

As you learn more about how your Company is performing on various dimensions and how the dynamics of your market are playing out, you'll inevitably want to make adjustments to your forecast. Whether you're just making simple assumption changes or need to rework some of your logic, Modeloptic makes both of those very easy to do.

As when doing your monthly reviews, being able to see transaction level detail from within your forecast is a huge advantage. That allows you to easily sanity check your forecast assumptions with what has been happening in reality, allows you to quickly investigate the timing of certain transactions, and helps you ensure that each line item is being forecast on an apples-to-apples basis with how things are categorized in your accounting system.

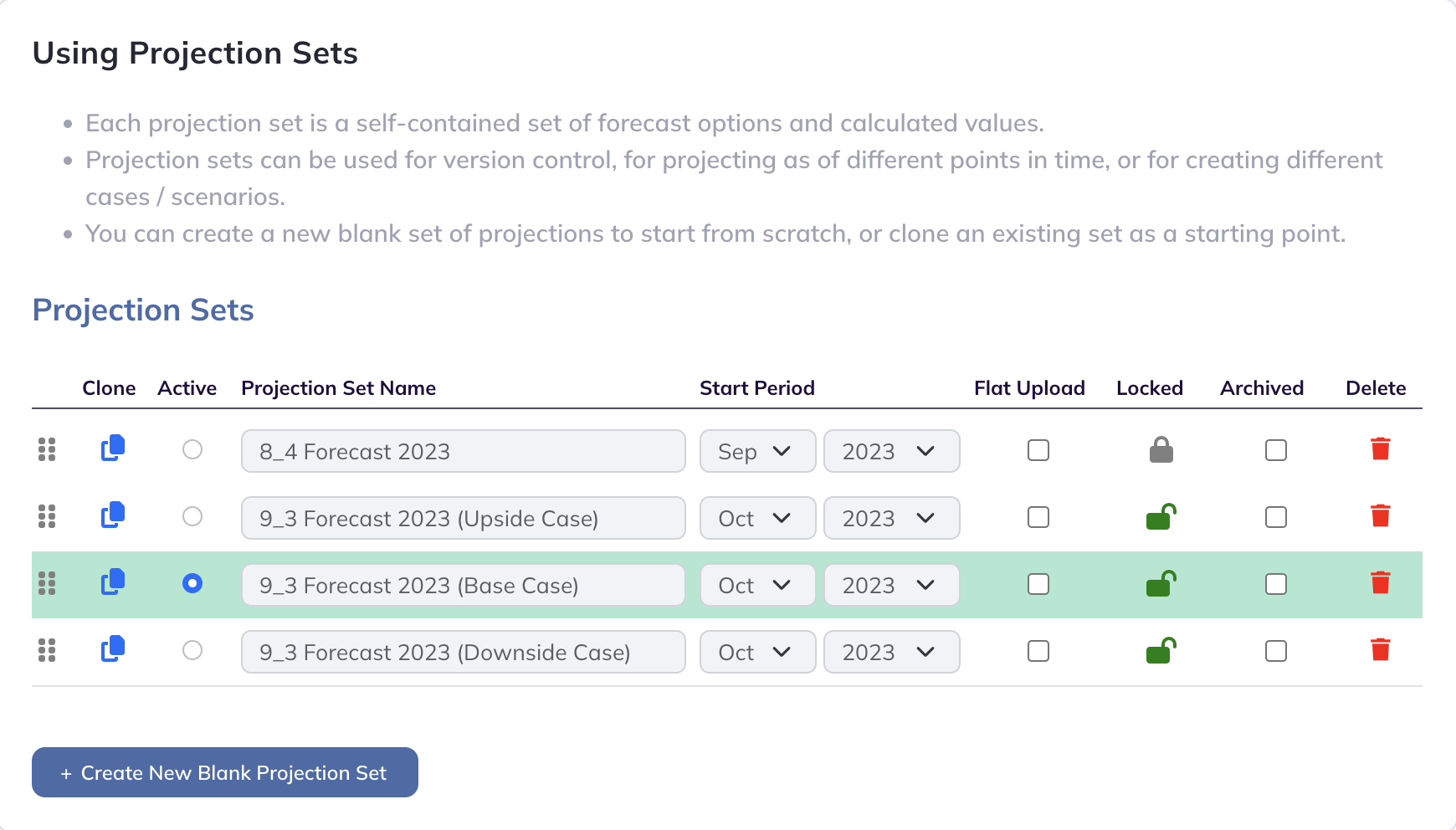

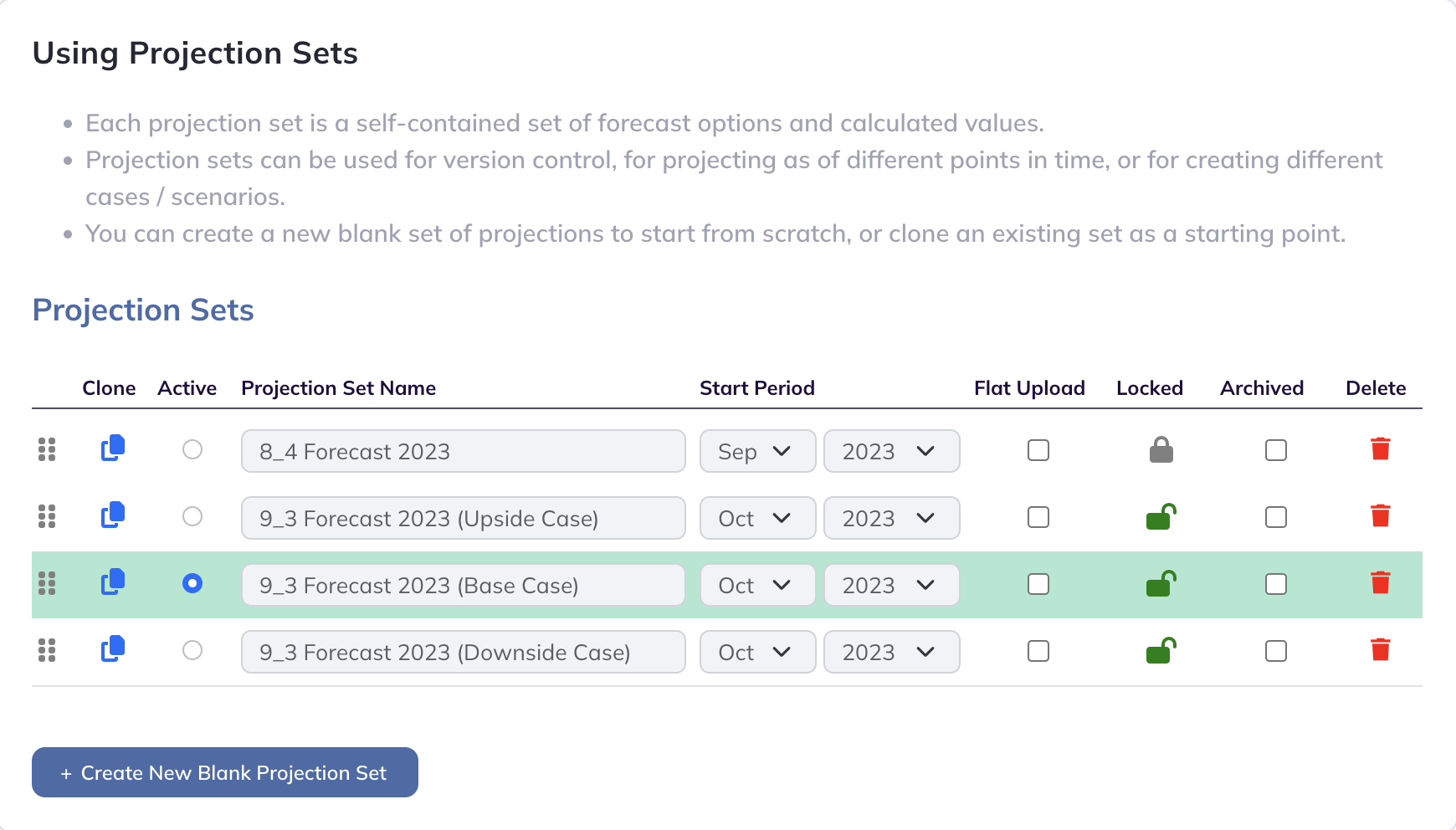

Modeloptic also retains a full record of all of your historical forecasts, allowing you to easily reference what you were forecasting at various points in time or in alternate scenarios.

It offers great off-the-shelf capabilities for quickly and easily building and adjusting your forecasts, while still maintaining the power and flexibility of Excel. It automates away most of the mechanical slog required in building a forecast in Excel.

Modeloptic directly integrates with your accounting system, so updating your model with the latest actuals is almost entirely automated.

You'll then load in any key operating metrics that are relevant to your business, both for the sake of integrating them into your reporting as well as for use as drivers in your forecast. By doing this, you'll have the full picture of your company, including non-finance KPIs, all in one place.

Instead of combing through every tab of your model every month and making sure every formula in every relevant cell is pointing to the correct place, Modeloptic can do all that for you. That eliminates many major potential sources of error, not to mention all that manual labor. Free yourself up to focus on higher value tasks!

When you do your monthly reviews as part of closing the books, much of that can be done right inside of Modeloptic. Having your variance reports generated for you automatically saves a ton of time, and removes major potential sources of error. Having those quickly available allows you to easily compare actuals versus plan and ensure that everything has been booked properly.

Doing your reviews within Modeloptic also gives you the major advantage of being able to see transaction level detail pulled from your accounting system from within your variance reports (as well as your forecast). Simply click on a historical value and you'll see the transaction components for the given period and account. You can't do that inside of Excel!

Modeloptic supports relative time references for items like graphs and data tables on your reports, so they'll automatically roll forward to show the correct periods along with your forecast.

You can then generate a PDF of your reports, or export whatever pieces you need to incorporate into other reporting materials you might be preparing.

As you learn more about how your Company is performing on various dimensions and how the dynamics of your market are playing out, you'll inevitably want to make adjustments to your forecast. Whether you're just making simple assumption changes or need to rework some of your logic, Modeloptic makes both of those very easy to do.

As when doing your monthly reviews, being able to see transaction level detail from within your forecast is a huge advantage. That allows you to easily sanity check your forecast assumptions with what has been happening in reality, allows you to quickly investigate the timing of certain transactions, and helps you ensure that each line item is being forecast on an apples-to-apples basis with how things are categorized in your accounting system.

Modeloptic also retains a full record of all of your historical forecasts, allowing you to easily reference what you were forecasting at various points in time or in alternate scenarios.

1) Other tools are made by tech people who try to build something for finance people. Modeloptic is built by finance people. We have deep corporate finance experience, we understand the problems of finance inside and out, and you'll see that understanding reflected everywhere in Modeloptic.

2) We embrace Excel. We love Excel, and think you probably do too. Modeloptic's interface aims to capture the good parts of Excel, especially its power, flexibility, and intuitiveness. If you're familiar with forecasting in Excel, you'll grasp forecasting in Modeloptic very quickly. Excel does have its downsides, though. It can be very tedious to update, and it's very easy to make errors that aren't easy to detect. Modeloptic aims to automate away as much of that manual labor as possible, and helps eliminate major potential sources of error.

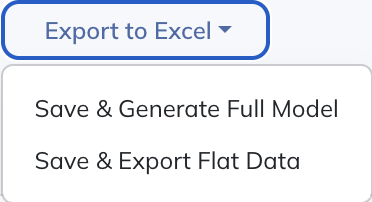

3) We can generate fully-functional Excel models. Once you build your model in Modeloptic, you can always regenerate in Excel with the click of a button, formulas and all. This makes it really easy to share your model with external parties with no friction. As far as we know, no other FP&A tool can do this.

4) Modeloptic is easy to implement, and easy to use (if you're familiar with basic finance concepts). We can have you up and running in a matter of hours. The most time-consuming step is simply getting your model built in the system. If you already have a good forecast that you just want transposed, setup is extremely quick. If you're building a new forecast or want to make significant edits, that can take a bit longer (mainly because that requires thinking through and iterating on new logic, which would be required no matter where you're building your forecast).

1) Other tools are made by tech people who try to build something for finance people. Modeloptic is built by finance people. We have deep corporate finance experience, we understand the problems of finance inside and out, and you'll see that understanding reflected everywhere in Modeloptic.

2) We embrace Excel. We love Excel, and think you probably do too. Modeloptic's interface aims to capture the good parts of Excel, especially its power, flexibility, and intuitiveness. If you're familiar with forecasting in Excel, you'll grasp forecasting in Modeloptic very quickly. Excel does have its downsides, though. It can be very tedious to update, and it's very easy to make errors that aren't easy to detect. Modeloptic aims to automate away as much of that manual labor as possible, and helps eliminate major potential sources of error.

3) We can generate fully-functional Excel models. Once you build your model in Modeloptic, you can always regenerate in Excel with the click of a button, formulas and all. This makes it really easy to share your model with external parties with no friction. As far as we know, no other FP&A tool can do this.

4) Modeloptic is easy to implement, and easy to use (if you're familiar with basic finance concepts). We can have you up and running in a matter of hours. The most time-consuming step is simply getting your model built in the system. If you already have a good forecast that you just want transposed, setup is extremely quick. If you're building a new forecast or want to make significant edits, that can take a bit longer (mainly because that requires thinking through and iterating on new logic, which would be required no matter where you're building your forecast).

The short answer is that if you can do it in Excel, you can almost certainly do it in Modeloptic.

We built Modeloptic to have great flexibility like Excel does. You can create custom line items and reference other lines to build up detailed forecasts, just like you can in Excel. We know that sometimes you need to build out detailed logic to capture the nuances of your particular business, so we don't dumb down the capabilities at all.

In fact, if you have a complex forecast, Modeloptic is almost certainly a better fit than Excel. Complex forecasts are usually also difficult to keep updated as well. By indicating which lines are Key Metrics for your business, Modeloptic gives you a specialized tool for managing those data points, both on the historical side and on the projection side.

Modeloptic can also handle division-level forecasts and multiple corporate entities. If you've ever tried doing frequent consolidations of multiple different forecast files in Excel, you know how painful that can be. With Modeloptic, you get those consolidations automatically, and can easily create linkages between the different entities. Each entity can connect to a separate accounting instance, or they can be mapped to Classes (or your accounting system's equivalent) within a single accounting instance. Modeloptic allows up to three tiers of hierarchy between your entities, and allows you to set granular user permissions so that members of your team have access to the areas relevant to them.

The short answer is that if you can do it in Excel, you can almost certainly do it in Modeloptic.

We built Modeloptic to have great flexibility like Excel does. You can create custom line items and reference other lines to build up detailed forecasts, just like you can in Excel. We know that sometimes you need to build out detailed logic to capture the nuances of your particular business, so we don't dumb down the capabilities at all.

In fact, if you have a complex forecast, Modeloptic is almost certainly a better fit than Excel. Complex forecasts are usually also difficult to keep updated as well. By indicating which lines are Key Metrics for your business, Modeloptic gives you a specialized tool for managing those data points, both on the historical side and on the projection side.

Modeloptic can also handle division-level forecasts and multiple corporate entities. If you've ever tried doing frequent consolidations of multiple different forecast files in Excel, you know how painful that can be. With Modeloptic, you get those consolidations automatically, and can easily create linkages between the different entities. Each entity can connect to a separate accounting instance, or they can be mapped to Classes (or your accounting system's equivalent) within a single accounting instance. Modeloptic allows up to three tiers of hierarchy between your entities, and allows you to set granular user permissions so that members of your team have access to the areas relevant to them.

Modeloptic is the real deal. We're finance and software experts with degrees from MIT and backgrounds working in NYC investment banking, running the finance organizations of billion-dollar public companies, and advising hundreds of companies of all stages.

100+ companies trust Modeloptic to help take their finance teams to the next level.

We invite you to try out our free demo and see the value for yourself. Schedule a call with us, and we think you'll be pleasantly surprised.

The Modeloptic platform has kept pace with our needs driven by explosive growth and increased complexity over the years including adding numerous subsidiaries. We've used Modeloptic through multiple funding rounds for all our forecasting and scenario modeling, and have shared these models with our investors. Additionally, the customer service that the Modeloptic team has provided has been par excellence.

I would highly recommend Modeloptic to organizations that have similar needs and growth plans."

Modeloptic is the real deal. We're finance and software experts with degrees from MIT and backgrounds working in NYC investment banking, running the finance organizations of billion-dollar public companies, and advising hundreds of companies of all stages.

100+ companies trust Modeloptic to help take their finance teams to the next level. Here's what some of them have to say about us:

The Modeloptic platform has kept pace with our needs driven by explosive growth and increased complexity over the years including adding numerous subsidiaries. We've used Modeloptic through multiple funding rounds for all our forecasting and scenario modeling, and have shared these models with our investors. Additionally, the customer service that the Modeloptic team has provided has been par excellence.

I would highly recommend Modeloptic to organizations that have similar needs and growth plans."

We invite you to schedule a call with us and see what Modeloptic can do first hand. We think you'll be pleasantly surprised.

Yes! You can sign up for a 14 day free trial here.

Keep in mind that since financial forecasts can be very complex, for you to get the real experience of Modeloptic, you would need to do a proper implementation.

That said, if you're using QuickBooks, Xero, NetSuite, or Sage Intacct, the trial will auto-generate a very basic model for you based on your existing chart of accounts to give you a quick taste of how things would look for you once fully set up.

Yes! You can try out our self service demo here.

If you'd prefer a live walkthrough, simply schedule a meeting and we'd be happy to chat.

Setup is very quick (especially compared to other software). The amount of time depends on how complex your company and forecast are and how extensive of changes you'll be making to your forecast and reporting during implementation, but most implementations can be completed within a week (assuming schedules align).

If you have a single corporate entity, you'll most likely go for the Standard Plan, which is $350/month.

If your business is more complex, we offer custom pricing depending on your particular circumstances.

See our pricing page for more details.

It does! You can subdivide your forecast into as many entities as you'd like, and Modeloptic will consolidate them all for you. Those entities can correspond to separate corporate entities, divisions within the Company, separate locations, or other delineations that might make sense for your Company.

If you're a giant enterprise, is depends on what specific needs you might have. There are some situations where we won't be the best fit, but we are a good fit in more cases than you might imagine.

If your product isn't in market or you're not set up on an accounting system yet, you're probably a little early to get the full value out of Modeloptic. But if you're about to be and want to be prepared for what comes, it can still be a good decision to get up and running early.

Send us a message or schedule a call with us and we'd be happy to discuss in more detail if we're a good fit for your circumstances.

Definitely! We offer consulting support services both to help you get set up and to help you maintain your financials on an ongoing basis.

See our pricing page for more details.

We currently have direct integrations with QuickBooks, Xero, NetSuite, and Sage Intacct (with more to come soon), which makes it very quick and easy to pull in your latest actuals easy month.

If you're not on one of those systems, you can also upload your historicals via Excel (which is still a huge win versus updating your model manually).

It can! By building your model in Modeloptic, the system can always generate your fully-functional model in Excel with the click of a button. The Excel model will look like just like it had been created by hand in Excel in the first place.

Not at all! We offer month-to-month contracts that are cancellable at any time, and you'll always be able to download a fully-functional version of your model to Excel.

Yes! You can sign up for a 14 day free trial here. Keep in mind though that the demo should be viewed on desktop and will not function well on a mobile device.

Also, since financial forecasts can be very complex, for you to get the real experience of Modeloptic, you would need to do a proper implementation.

That said, if you're using QuickBooks, Xero, NetSuite, or Sage Intacct, the trial will auto-generate a very basic model for you based on your existing chart of accounts to give you a quick taste of how things would look for you once fully set up.

Yes! You can try out our self service demo here. Keep in mind though that the demo should be viewed on desktop and will not function well on a mobile device.

If you'd prefer a live walkthrough, simply schedule a meeting and we'd be happy to chat.

Setup is very quick (especially compared to other software). The amount of time depends on how complex your company and forecast are and how extensive of changes you'll be making to your forecast and reporting during implementation, but most implementations can be completed within a week (assuming schedules align).

If you have a single corporate entity, you'll most likely go for the Standard Plan, which is $350/month.

If your business is more complex, we offer custom pricing depending on your particular circumstances.

See our pricing page for more details.

It does! You can subdivide your forecast into as many entities as you'd like, and Modeloptic will consolidate them all for you. Those entities can correspond to separate corporate entities, divisions within the Company, separate locations, or other delineations that might make sense for your Company.

If you're a giant enterprise, is depends on what specific needs you might have. There are some situations where we won't be the best fit, but we are a good fit in more cases than you might imagine.

If your product isn't in market or you're not set up on an accounting system yet, you're probably a little early to get the full value out of Modeloptic. But if you're about to be and want to be prepared for what comes, it can still be a good decision to get up and running early.

Send us a message or schedule a call with us and we'd be happy to discuss in more detail if we're a good fit for your circumstances.

Definitely! We offer consulting support services both to help you get set up and to help you maintain your financials on an ongoing basis.

See our pricing page for more details.

We currently have direct integrations with QuickBooks, Xero, NetSuite, and Sage Intacct (with more to come soon), which makes it very quick and easy to pull in your latest actuals easy month.

If you're not on one of those systems, you can also upload your historicals via Excel (which is still a huge win versus updating your model manually).

It can! By building your model in Modeloptic, the system can always generate your fully-functional model in Excel with the click of a button. The Excel model will look like just like it had been created by hand in Excel in the first place.

Not at all! We offer month-to-month contracts that are cancellable at any time, and you'll always be able to download a fully-functional version of your model to Excel.