Lender Financial Model Excel Template

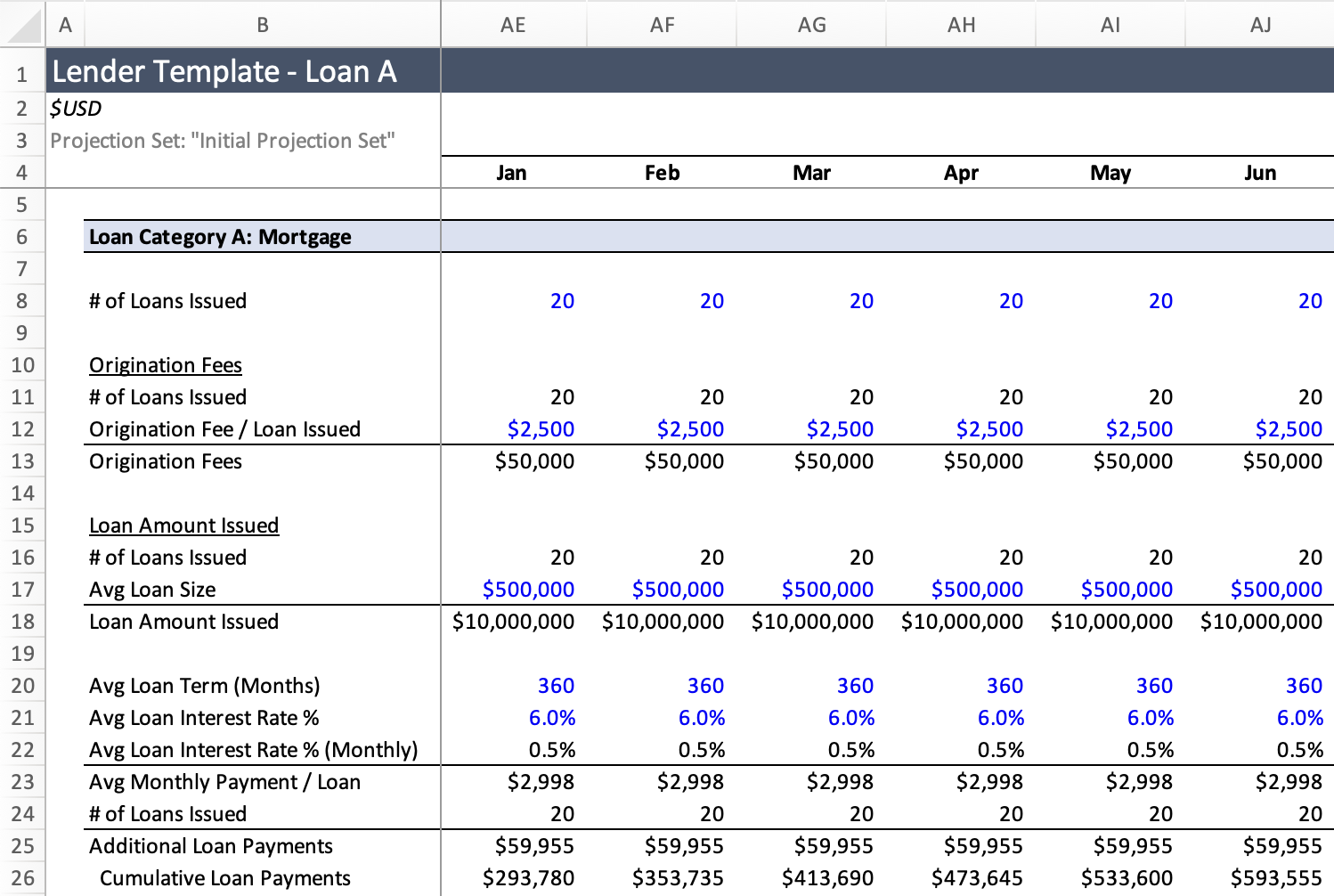

This comprehensive Excel financial model template is designed to forecast the future performance of a Lending company (mortgage, factoring, specialty lending, banking, etc). It includes the following features:

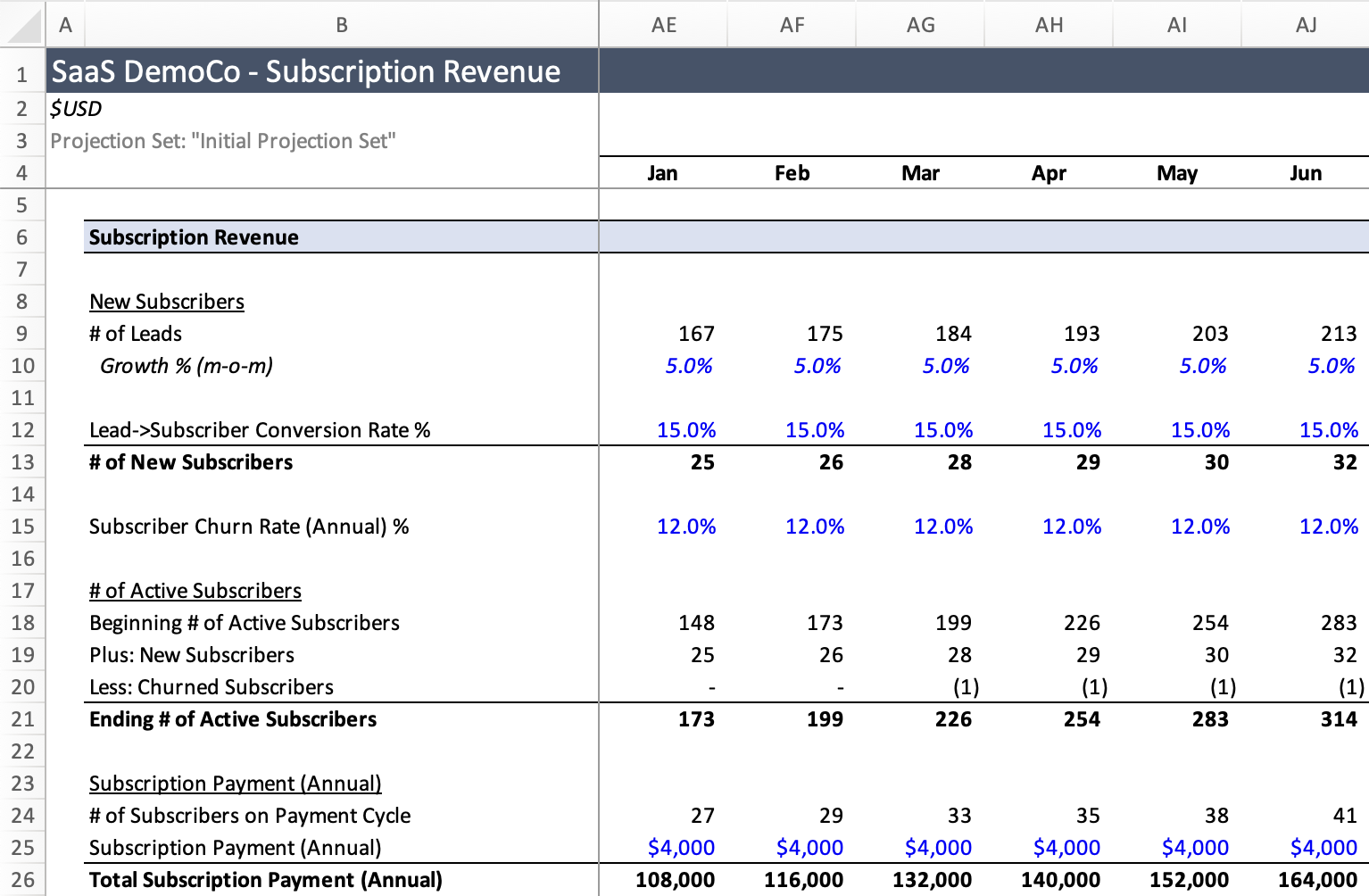

Forecast various different lending products using different repayment structures, financing terms, and bad debt reserve assumptions

Ability to forecast by individual customer or in aggregate using averages

Flexible financing structures to fund loan origination, including multiple debt tranches, a revolving credit facility, and equity components

Detailed personnel forecast broken down by role and department

Thorough tax forecasting, accounting for deferred tax assets and timing of payments

Key Metrics overview including originations by product, net interest margin, leverage ratios, headcount by department, and more

Get Your Free Template

Once you proceed to "Get the Template" above, you'll be able to download it in Excel.

You'll also have access to the same template built within a live instance of Modeloptic that you can edit using our tools.

You'll also have access to the same template built within a live instance of Modeloptic that you can edit using our tools.

Get Your Free Template

Once you proceed to "Get the Template" above, you'll be able to download it in Excel.

You'll also have access to the same template built within a live instance of Modeloptic that you can edit using our tools.

You'll also have access to the same template built within a live instance of Modeloptic that you can edit using our tools.

Powerful and Intuitive Financial Reporting & Projection Software

Powerful and Intuitive Financial Reporting & Projection Software

Related Templates

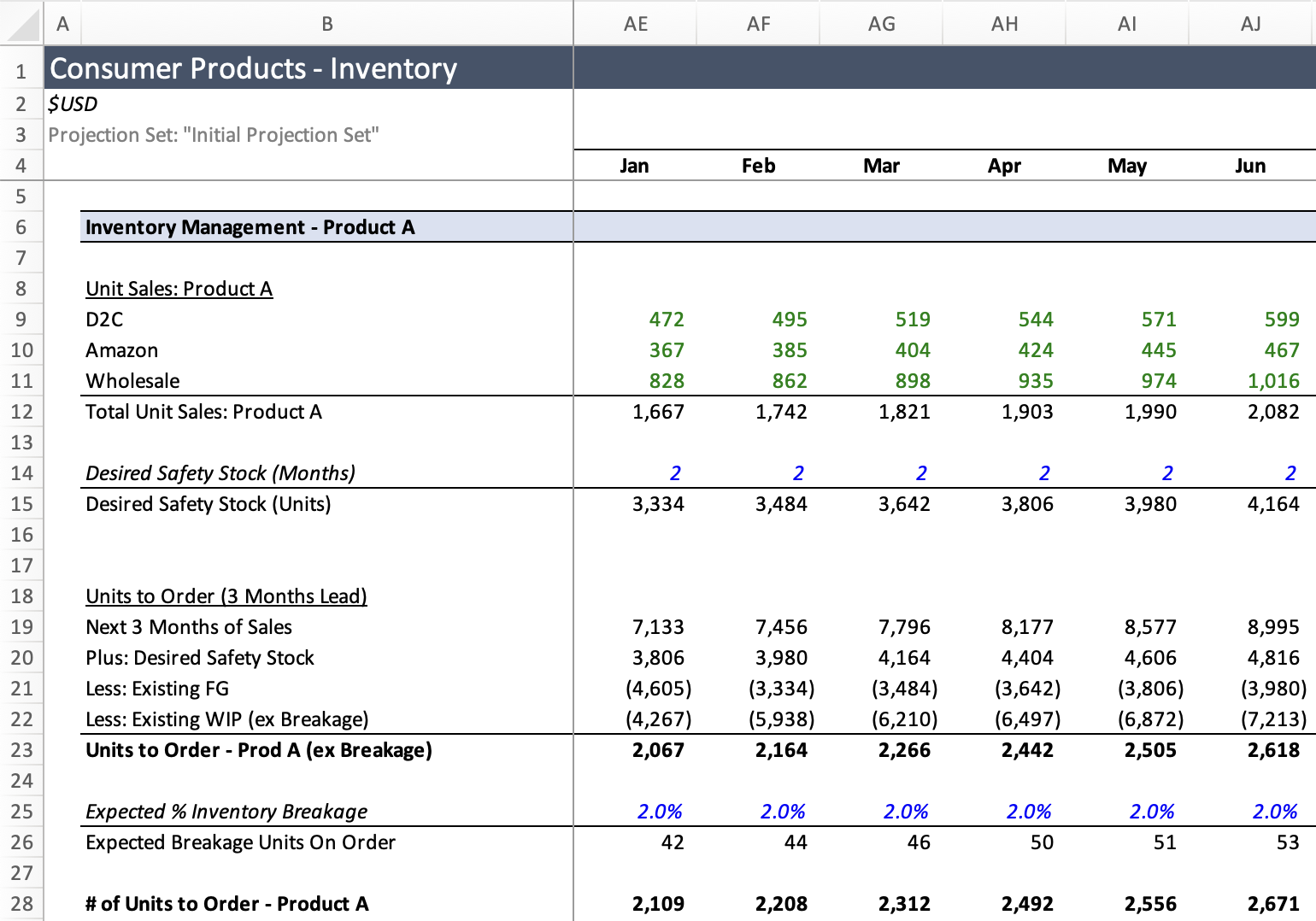

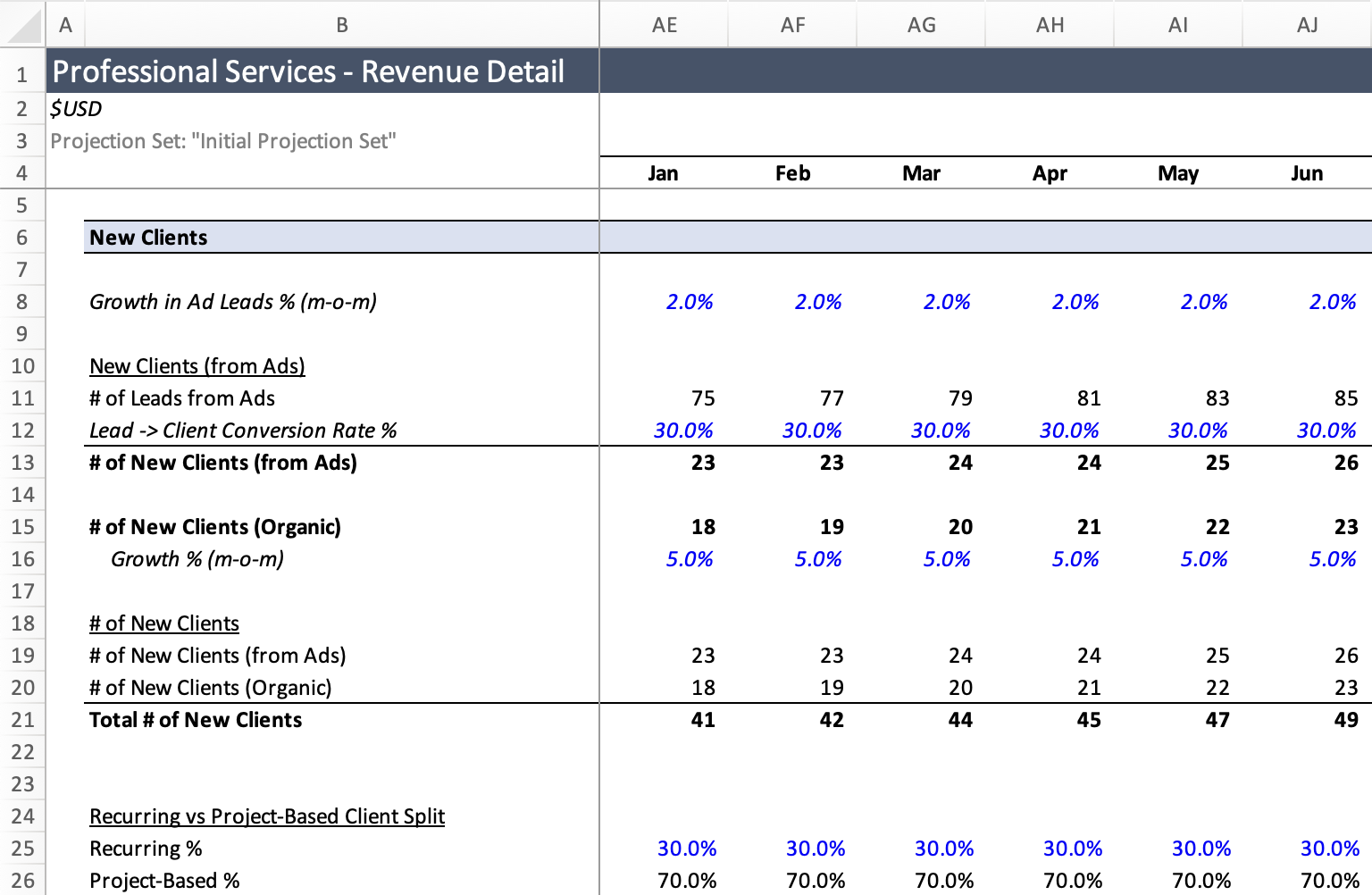

Tailored templates for a variety of business models.

Start with one of our templates to build out your forecast.

Start with one of our templates to build out your forecast.